10 Mistakes To Avoid In Debtor Management (Especially Number 9)

This month, Aj Singh, CEO at ezyCollect tells us the top 10 mistakes in debtor management that every business should avoid. Want to get paid faster and improve cash flow? Read on…

If your sluggish cash flow is slowing your growth and you’re losing sleep worrying about how to get customers to pay up, it might be time to re-think how you’ve been managing your debtors.

Fine-tuning your internal efforts to collect cash can quickly reverse a detrimental late payments trend. Improve your collection times by avoiding these common mistakes in debtor management…because you’ve earned the right to be paid on time!

Mistake #1 Issuing trade credit to bad payers

Every time you offer trade credit to a new customer, you introduce a new risk to your business. Will they pay late? What if they default? Even businesses which are great at managing risks in other parts of their business fail to manage the cash flow risk of bad payers. The good news is, you don’t need to operate blindly. You can order a credit check report from a national reporting bureau like Equifax. Credit reports detail your new customer’s recorded credit transaction history and provide an assessment of their default risk.

With a credit transaction history in front you, you can mitigate late payment risks from debtors by offering less credit and shorter payment terms.

Mistake #2 Not issuing invoices immediately

Every day that an invoice is unpaid is money lost from your own cash cycle. Make sure your sales and accounts teams are aligned so that new sales are quickly invoiced, giving your customers the opportunity to process your payment in their next payment schedule.

Mistake #3 Not sending reminders

Have you heard the saying ‘The squeaky wheel gets the oil’? Apply that to debtor management. If you’re not consistently communicating about your payment expectations, your customers could allow your invoices to linger while they respond to suppliers who are good at asserting their expectation of being paid on time.

Mistake # 4 Relying on one reminder

You’ve found the time to send one reminder and sit back, expecting the money to roll in. Unfortunately, one reminder is often not enough. At ezyCollect, we’ve found that most invoices in MYOB Acumatica (formerly MYOB Advanced) are paid after the second reminder. Because sending reminders can be time-intensive when done manually, many businesses don’t find the time to give their customers the extra nudge that prompts a payment.

Mistake #5 Bombarding customers unnecessarily

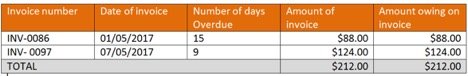

The opposite of not sending reminders is over-communicating, and that’s a mistake, too. You’re bombarding customers if you’re sending a reminder for every invoice instead of consolidating all overdue amounts into each reminder. And if your customer has to ask you to re-send the invoice, that’s another unnecessary communication – simply attach a copy of invoices in every reminder, and include an overdue invoice table so customers can quickly understand their total debt. (N.b.: ezyCollect does this automatically).

ezyCollect consolidates overdue invoices into a table and communicates about total amounts overdue

Mistake #6 Writing reminders in anger or haste

We all understand the frustration of not being paid on time, but that feeling shouldn’t drive the tone of your reminders. Angry reminders can derail your customer relationship, especially if your customer has simply forgotten to pay or is experiencing cash flow problems themselves.

Have pre-written invoice reminder templates that are considered, polite and in the tone of your business. Then populate them with relevant information as needed. Be assertive. Be empathetic. Invite a conversation. You want your reminders to open the door to a payment conversation, not slam it shut.

Mistake #7 Maintaining incomplete debtor contacts

It’s going to be hard to issue and chase invoices if you haven’t got at least one correct debtor contact in your database. Train your sales and accounts staff to regularly update your database with debtor contact details by email, SMS, post, even fax if they have it. If one channel fails to reach your debtor, you have other options to try. While we all rely on email, don’t underestimate the value of SMS messages to bypass overburdened inboxes and reach debtors quickly.

Mistake #8 Not addressing disputes

The 2017 late payments inquiry found that a common cause of late payments is disputes over the quantity and quality of goods or services provided. You may even have a clause in your contracts which allows the buyer to withhold payment when any aspect of supply is in dispute. If your customer disputes your invoice, investigate their concerns. Persisting with invoice reminders on disputed invoices will not address the root cause of the late payment.

Mistake #9 Not offering online payments

It’s the digital age and your customers are used to transacting online. If they still need to call you and catch you in the office so you can process their payment, or worse, dig out a chequebook, expect delays. At ezyCollect, we’ve found an increasing trend in businesses settling their bills online, after hours. When you start collecting money online, it’s easier for debtors to pay you.

Mistake #10 Wasting time and talent

Around 1 in 8 small businesses lose close to a day each week chasing late payments. Talented staff are bored and frustrated with the seemingly endless task of manually communicating with a long list of overdue debtors. With automation costing from as little as $12/day for MYOB Acumatica (formerly MYOB Advanced) users (and working 24/7), it’s no longer necessary to lose time and talent to tedious manual tasks.

It’s easy to avoid the common mistakes in debtor management with a purpose-built, hands-free approach to debtor management. To learn more about how ezyCollect and MYOB Acumatica (formerly MYOB Advanced) can improve your collection times, call us on 1300 045 046 or email info@leveragetech.com.au.

Leave A Comment