Automated Accounts Receivables: 10 Ways It’s Helping Businesses Like Yours

With MYOB Acumatica (formerly MYOB Advanced) on board, you’ve already made the decision to run a smarter, more efficient business.

Cloud technology delivers real-time data, automated processing, and less paperwork. For companies riding the cloud, improving day-to-day efficiencies is par for the course. Accounts receivable, often overlooked, has huge potential for automation, and the associated cash flow and productivity benefits are worth a closer look.

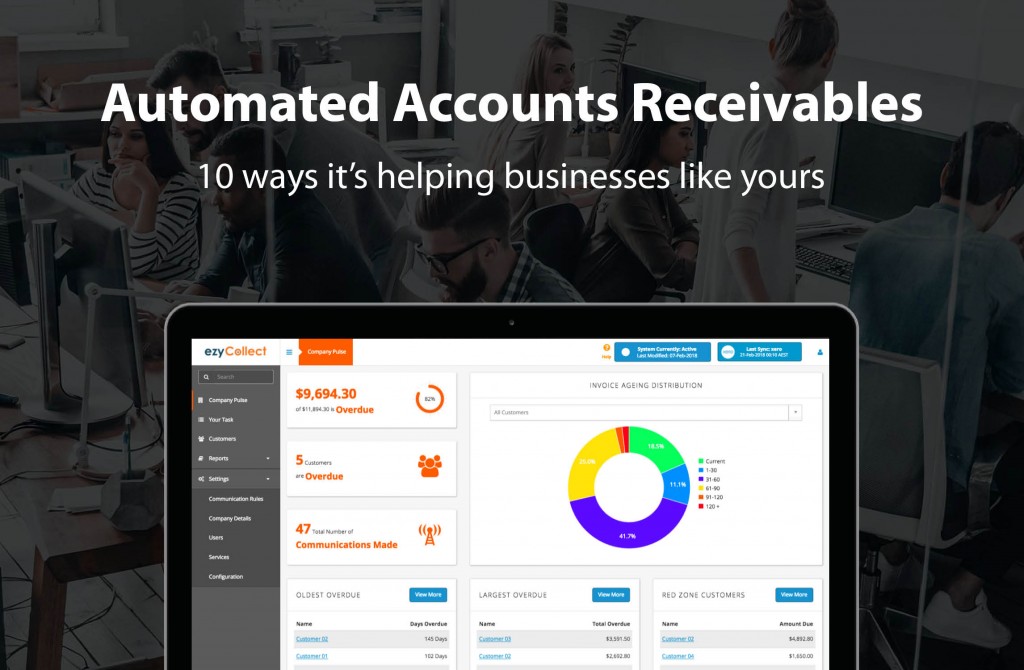

We talk to Aj Singh, CEO of ezyCollect, to learn how businesses are getting ahead with automated AR.

10 Ways Automated Accounts Receivables Can Help Your Business

1. Saving time on chasing tasks

It’s common for customers to delay payment until they receive a reminder from the supplier. “We’ve found that 52 percent of debtors require three or more reminders before they pay, “ says Aj. The burden is on suppliers to chase for payment, but according to Aj, businesses that automate reminders are saving time: half a day to a day a week. “Bigger businesses with more debtors save even more time. Enterprise businesses have been losing as much as 100 hours per month manually chasing payments. Now they don’t have to.”

2. Cash flow improves

“When you bring down debtor days by reminding customers to pay, cash flow improves,” says Aj, who has ezyCollect customers who’ve slashed debtor days by as much as 50-75 percent in the first three months. “One accountant told us his client’s cash flow improved to the extent that he could stop using credit financing to cover cash flow shortfalls and became cash flow positive within three months.”

3. A daily to-do list for busy staff

With potentially hundreds of invoices in your system, it can be hard to know which debtors are due a reminder phone call. With automation, the system emails you a list of debtors who have triggered a phone call alert. “Getting a call list is helpful for admin and accounts staff who don’t have time to individually track debtors; they know exactly who to call that day,” explains Aj.

4. Management dashboard

Mapping, tracking and recording of accounts receivables is done for you with automation. Charts give your accounts receivables high visibility and help management to take decisive action. “The system gives managers a real-time snapshot of which debtors are entering their danger zone of defaulting, which debtors have the most owing and so on,” explains Aj. “Managers are making better decisions with more information at their fingertips.”

5. One centralised hub

One single view of accounts receivables is helping to keep accounts teams updated and on the same page. “Bookkeeping and accounting firms read real-time data from their clients’ files, and in-house accounts teams can see the same insights so everyone knows how debtors are being managed. No more spreadsheets and silos of information” says Aj.

6. Better risk assessment and management

Because it’s easy to order a credit check report from within ezyCollect, Aj sees businesses being more proactive in their assessment of credit risk. “Now businesses have the habit of checking a new customer’s credit history before confirming the terms of trade. It’s part of their new customer onboarding process and it’s saving them from headaches down the track.” Monitoring credit usage is easier too, as credit limits can be allocated to every debtor and the system tracks usage. “Accounts teams are looking at credit usage then informing the sales teams so they’re not allowing customers to exceed their credit limit,” explains Aj.

7. Accepting payments online

“We can see from our data that the most popular time for making a payment is at 11 o’clock in the morning and that increasingly, businesses are settling their bills after closing time. If you’re not available to collect cash when your customers are ready to pay, you won’t get paid that day,” says Aj. By offering online payments, ezyCollect allows its MYOB Acumatica users to add a Pay Now button on reminders and link to online payments from invoices. “It’s helping businesses collect more money, faster,” says Aj.

8. Improved customer communications

It can be hard to know how to effectively communicate your payment expectations to customers. Automation lets you pre-determine your sequence of communications (when your first, second and third reminders go out, etc.) and also allows you to personalise reminder templates with your tone. The system then populates your templates with relevant information from your invoices like the debtor’s name, total amounts overdue etc. “Businesses are no longer writing payment reminders in haste and are clearly articulating everything their debtor needs to know. Customers don’t mind receiving polite reminders, they’re grateful for them,” says Aj.

9. Improved job satisfaction

“We get a lot of people wanting to automate payment reminders because their staff just don’t enjoy doing collections. It’s a daunting task and not very satisfying, especially if they don’t have the time to reach every debtor who needs a reminder,” says Aj. “Once they start automating, they can allocate their skills to other parts of the business that can use their time and talents.”

10. A collection ecosystem

Many times, a business may send one reminder to debtors, then no other follow-up. That’s a mistake, says Aj, who has built an ecosystem of collection partners to keep the collections ball rolling. “Once the system has sent a series of reminders for you, you then have the option to click and send a demand letter or click to outsource to a debt collector. It’s more options at your fingertips and it keeps businesses tracking towards making a collection versus accruing a bad debt.”

If cash flow and productivity are front of mind in your business, automating accounts receivables could be your next best step. For help with streamlining your credit management or to learn more about how a Cloud-based ERP system can help your business grow further call us on 1300 045 046 or email info@leveragetech.com.au.

Leave A Comment