5 MYOB Advanced Functionalities That Will Skyrocket your FinTech Company in 2018

The fintech (financial technology) industry in Australia has been steadily growing over the last few years.

From 2012 to 2016, investment into the sector has increased more than 12-fold. Meanwhile, the number of Australian fintech companies rose from fewer than 100 in 2014 to nearly 600 in just three short years. Australia’s fintech landscape is becoming increasingly diverse, although payment and lending are stand-out areas. Various areas are steadily growing and new ones emerging too, expanding the fintech market. Australia is bucking the global trend of falling investment in fintech. However, the sector still needs to exercise caution if it wants to survive against the challenges of international firms and disruptive startups.

Why MYOB Advanced ERP For FinTech and Financial Services Companies?

With the fintech industry in Australia continuing to grow, organisations within the sector need access to the right tools to help them thrive and compete in the market. MYOB Advanced is a cloud-based ERP software, which launched in 2015, using Amazon Web Services as its local hosting provider. The launch of the product came at the perfect time to meet growing demands from the fintech industry for cloud-based ERP solutions. The subscription-based SaaS product offers a universal database search, as well as a distribution suite and productivity tools.

Organisations already existing in the fintech space, as well as those planning to enter the market in the near future can ensure they perform well when they use MYOB Advanced as their preferred business management system. It provides a fantastic range of solutions that make it the perfect tool for fintech organisations, thanks to its specialised financial functions designed to meet their needs. Here are the top five benefits MYOB Advanced ERP offers fintech organisations that have helped many to thrive in this growing market.

-

Flexible financial reporting, forecasting and more

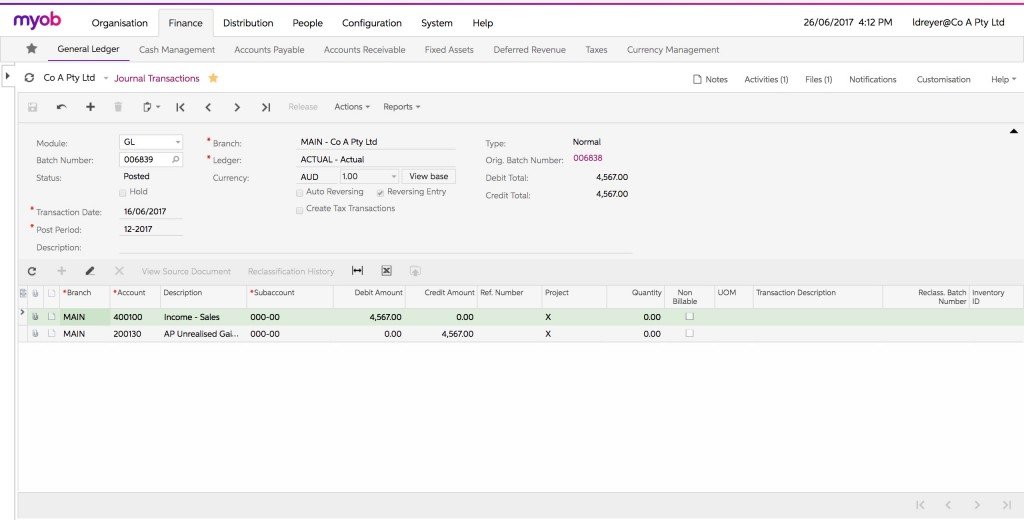

MYOB Advanced General Ledger functionality makes flexible financial reporting and analysis available. The comprehensive tools make it simple to structure and organise accounts, in addition to customised reporting and forecasting. Being able to create both accounts and sub-accounts allows for customisation and data segmentation. Role and access permissions make it easy to protect sensitive data in any account or sub-account and only share it with the people who need to see it.

Data is easily consolidated from different accounts, even when dealing with different currencies or structures. Accessing reports is quick and easy, and any modifications can be tracked for audit reports. With tools allowing for multiple currency use, setup of recurring transactions and configuration of financial periods, everything is possible in just a few clicks. For more information or to get a better idea of Financial Reporting in MYOB Advanced check the demo video.

-

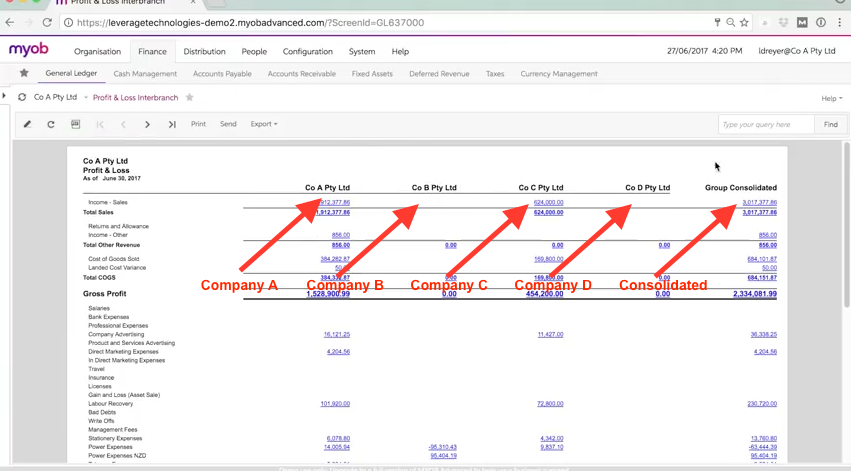

Intercompany accounting

Organisations managing a number of companies and entities at the same time benefit from intercompany accounting from MYOB Advanced. Use one centralised system to manage various financials across an unlimited number of companies. Access to specific companies or transactions is easily restricted to roles or groups, and inter-company transactions can be limited to certain accounts. Tools allow for assigning, transferring and tracking assets.

Organisations can bring invoicing and purchasing together in one place, while bank accounts can still be kept separately for each company. MYOB Advanced intercompany accounting capabilities make streamlining financials across different companies easier than ever before.

-

Recurring revenue management

Revenue management doesn’t need to be hard with the tools provided by MYOB Advanced. It’s important to be able to adapt your revenue management as your business grows, and MYOB Advanced’s tools make it simple to build a scalable business model. Customise billing models so that they work for your business requirements at any stage of growth, from startup to flourishing business. Better billing accuracy and cash flow allow for improved revenue opportunities thanks to recurring revenue management. Billing, payments and collections can all be set up as recurring actions, with excellent billing flexibility to set custom schedules.

Flexible pricing models mean companies can set up licenses, subscriptions and other complex pricing systems without any difficulty. These tools are ideal for fintech SaaS management or subscription services. Templates remove the need for repetitive actions or wasting time setting up billing rules and allocation, as well as improving billing accuracy. Flexibility is also offered for billing contracts, which can be changed and cancelled at any time. Automated scheduling and activity management can boost the chances of renewal revenue too.

-

Project cost tracking

Manage your next round of funding in a way that is transparent for stakeholders. Project cost management software allows you to automatically budget and track costs, integrating seamlessly with your financials. Increased accountability for spending and returns for specific projects can be achieved thanks to a complete cost view with real-time updates and billable revenue tracking.

No matter the size of the project, data entry and simple information access make them easy to manage. You can put billing rules in place and allocate resources to tasks, projects, employees and managers. Create and define tasks with templates, task definition and assigning billing rates. Tasks are simple to update too, with fully integrated modules, useful for using with CRM tools.

-

Australia-based provider and support

Australian-based fintech firms benefit from access to localised support, based in Australia and not overseas. As a MYOB Advanced Business Partner, Leverage Technologies has experience in the field and is here to act as your dedicated provider and support whenever you need it. We are an innovative organisation serving small and medium businesses across Australia, with experience and knowledge of supporting organisations in the fintech industry. Founded in 2005, we have years of experience working with ERP systems, with more than 50 in-house experts ready to attend to your every need. Our award-winning team has helped more than 250 businesses in multiple industries during that time, with a focus on innovation and helping ERP vendors to perfect their products. We have locations in Sydney, Melbourne, and Brisbane to provide for our clients in different areas.

MYOB Advanced is an excellent choice for organisations looking for the perfect FinTech ERP solution. If your small or medium business is growing and you need the right tools to support it, MYOB Advanced can give you everything you need.

Want to learn more about MYOB Advanced? Access your FREE demo right here.

Leave A Comment